This adds a sense of high impact and seriousness, highlighting the potential consequences of a margin call in Forex trading. A margin call in Forex trading occurs when a trader’s account equity falls below the required margin level set by their broker. In Forex trading, a margin is a good-faith deposit required to open and maintain a leveraged position. If the market moves against the trader’s position and their account equity drops below the maintenance margin level, the broker issues a margin call. This notification is essentially a demand for the trader to either deposit additional funds or close some positions to reduce the margin level and avoid a forced liquidation.

The purpose of a margin call is to protect both the trader and the broker from potential losses. By requesting additional funds or position adjustments, the broker ensures that the trader’s account remains sufficiently funded to cover potential losses. If the trader fails to meet the margin call, the broker may automatically close out positions to limit further losses and protect the integrity of the trading account.

How Does a Margin Call Work in Forex?

When a margin call is triggered, the trader’s account is evaluated to determine if there is sufficient equity to maintain the current positions. If the equity falls below the broker’s margin requirement, the broker will issue a margin call, prompting the trader to either deposit additional funds or reduce the size of their trades. The broker typically communicates the margin call through a notification or alert within the trading platform or via email.

In response to a margin call, the trader must act quickly to avoid the automatic liquidation of their positions. This often involves adding more funds to the account or closing some trades to bring the equity back above the required margin level. If the trader fails to take corrective action, the broker may close out positions at prevailing market prices, which could result in significant losses.

Why Do Margin Calls Occur in Forex Trading?

Margin calls occur primarily due to adverse price movements in the market that lead to a decrease in the trader’s account equity. In Forex trading, leverage allows traders to control large positions with relatively small amounts of capital. While leverage can amplify profits, it also increases the risk of substantial losses. When the market moves against a trader’s position, the value of their account can quickly erode, triggering a margin call if it falls below the required level.

Another reason for margin calls is high market volatility. Rapid and unpredictable changes in currency prices can cause significant fluctuations in a trader’s account balance, potentially leading to margin calls. Additionally, inadequate risk management strategies or improper use of leverage can exacerbate losses and increase the likelihood of receiving a margin call. Properly managing leverage and maintaining sufficient margin levels are crucial to minimizing the risk of margin calls and protecting trading capital.

What Happens After a Margin Call is Issued in Forex?

Once a margin-call is issued, the trader is required to take immediate action to rectify the situation. This typically involves depositing additional funds into the account to bring the equity back above the required margin level. If the trader fails to respond to the margin-call by adding funds, the broker may automatically close out some or all of the trader’s positions to reduce the margin requirement and prevent further losses. These forced liquidations are done at prevailing market prices, which can result in significant losses if market conditions are unfavorable.

After a margin-call, the trader’s account will be re-evaluated to ensure it meets the required margin levels. If the trader has deposited sufficient funds or adjusted their positions, the margin-call will be resolved, and trading can continue. However, if the trader does not take corrective action, the account may be further impacted by additional forced liquidations or even a complete closure of positions. This can leave the trader with a reduced account balance and a need to reassess their trading strategies and risk management practices.

What Triggers a Margin Call in Forex?

A margin-call in Forex trading is triggered when the equity in a trader’s account falls below the broker’s required margin level. This typically occurs due to adverse price movements in the market that cause the trader’s open positions to lose value. When the account equity drops below the maintenance margin, the broker issues a margin call to protect against further potential losses. For example, if a trader uses leverage to control a large position and the market moves significantly against that position, the resulting loss can deplete the account balance to the point where a margin call is necessary.

Leverage amplifies both potential profits and losses, making it a common cause of margin-calls. High volatility in the Forex market can also trigger margin calls. Sudden and sharp price fluctuations can quickly erode account equity, leading to a situation where the trader’s current margin level is insufficient to cover the open positions. As a result, the broker steps in to manage risk by requesting additional funds or closing out positions to restore the account to a more secure level.

How Can You Avoid a Margin Call in Forex Trading?

To avoid a margin-call, it is essential to practice prudent risk management. One effective strategy is to use lower leverage, which reduces the impact of adverse price movements on your account equity. By trading with lower leverage, you ensure that your account can better absorb market fluctuations without falling below the required margin levels. Additionally, setting stop-loss orders can help limit potential losses on open positions, preventing your account equity from declining too quickly.

Another important practice is to monitor your positions and account balance regularly. Keeping a close eye on market conditions and your equity helps you make timely decisions to adjust your positions or add funds before a margin-call is triggered. Maintaining a sufficient buffer in your account can also provide a safety net against margin calls. By combining these strategies, you can manage risk more effectively and reduce the likelihood of facing a margin-call.

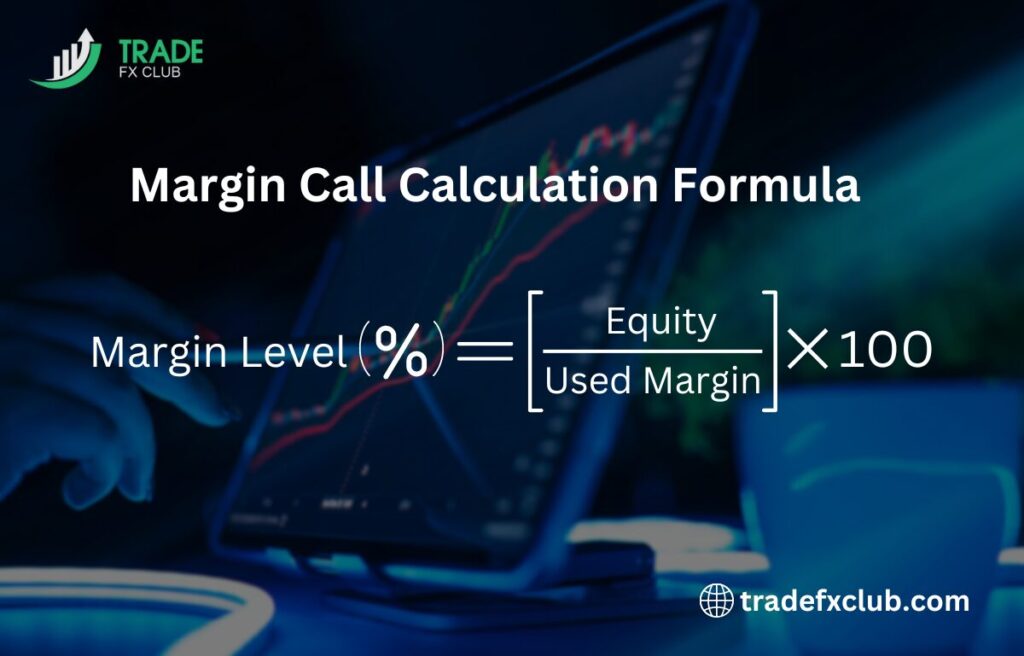

How is Margin Level Calculated in Forex?

The margin level in Forex is calculated to determine the ratio of a trader’s equity to the used margin in their account. The formula for calculating the margin level is:

{Margin Level} = {Equity}{Used Margin}\100

Here, equity refers to the total value of the trader’s account, including any unrealized profits or losses. The used margin is the amount of money required to maintain the trader’s open positions. The margin level is expressed as a percentage, and it indicates the safety cushion available to cover potential losses on current positions. A higher margin level signifies a more secure trading position with a greater buffer against margin calls, while a lower margin level indicates increased risk and a higher likelihood of a margin call if market conditions deteriorate.

What are the Consequences of Ignoring a Margin Call?

Ignoring a margin-call in Forex trading can have severe consequences for a trader’s account. When a margin-call is issued, it signifies that the account equity has dropped below the required margin level due to adverse market movements. If the trader fails to respond by depositing additional funds or adjusting their positions, the broker will take action to protect against further risk. This typically involves the automatic liquidation of some or all of the trader’s open positions. Such forced liquidations are carried out at prevailing market prices, which can result in significant losses and reduce the trader’s account balance.

In addition to financial losses, ignoring a margin call can damage the trader’s reputation with their broker. Brokers may impose stricter trading conditions or limit access to leverage in the future for traders who consistently ignore margin calls. This can impact the trader’s ability to engage in leveraged trading, potentially limiting their trading opportunities and profitability. Moreover, frequent margin-calls and subsequent forced liquidations can lead to emotional stress and a loss of confidence in trading strategies.

What is the Role of Leverage in Margin Calls?

Leverage plays a crucial role in margin calls by amplifying both potential gains and losses in Forex trading. Leverage allows traders to control large positions with a relatively small amount of capital. While this can magnify profits, it also increases the risk of significant losses. A higher leverage ratio means that a small adverse movement in the market can lead to a larger impact on the trader’s account equity, making margin calls more likely.

When leverage is high, the margin required to open and maintain positions is relatively small compared to the total value of those positions. This increased risk of loss due to leverage can cause the trader’s account equity to quickly fall below the required margin level, triggering a margin call. Therefore, while leverage can enhance trading opportunities, it also demands careful risk management to prevent margin calls and protect trading capital. Properly managing leverage and maintaining sufficient margin levels are essential to mitigating the risks associated with leveraged trading.

How Can Risk Management Prevent Margin Calls?

Effective risk management is crucial for preventing margin-calls in Forex trading. One key aspect is to use appropriate leverage levels that align with your risk tolerance and trading strategy. By opting for lower leverage, you reduce the potential impact of adverse market movements on your account equity, making it less likely that your account will fall below the margin requirement. Additionally, setting stop-loss orders on your trades helps to limit potential losses and prevent significant declines in account equity, which can mitigate the risk of margin calls.

Another important risk management practice is to diversify your trades. Avoiding concentration in a single currency pair or market sector helps to spread risk across different assets, reducing the likelihood that a single adverse movement will trigger a margin call. Regularly reviewing and adjusting your trading positions based on market conditions and your account balance ensures that you maintain adequate margin levels and are better prepared to respond to market fluctuations.

What Are the Best Practices for Handling a Margin Call?

When a margin call is issued, prompt and decisive action is essential to avoid further complications. The first best practice is to quickly deposit additional funds into your trading account to bring the equity back above the required margin level. This immediate response helps to restore the account’s margin level and prevent the automatic liquidation of positions by the broker. Ensuring that you have sufficient liquidity in reserve can make this process smoother and more manageable.

Another best practice is to carefully evaluate and potentially close out some of your open positions to reduce the used margin. By doing so, you can lower your margin requirements and avoid the forced liquidation of trades. It is also important to review your trading strategy and risk management practices after a margin call to identify any weaknesses and make necessary adjustments. Learning from the experience can help you better manage your trades and reduce the risk of future margin calls.

How Do Different Forex Brokers Handle Margin Calls?

Different Forex brokers may have varying procedures for handling margin-calls, but generally, they follow a standard approach to manage risk and protect their clients’ accounts. Most brokers issue a margin call when a trader’s account equity falls below a certain threshold, prompting the trader to either deposit additional funds or reduce their open positions. Some brokers may provide a grace period for traders to address the margin-call before taking further action, while others may act more quickly to close out positions if the margin call is not met.

Brokers also differ in their margin-call policies regarding the level at which they trigger liquidation. For example, some brokers may automatically close out positions when the margin level falls below a certain percentage, while others might allow for a slightly lower margin before taking action. Additionally, brokers may use different methods for notifying traders about margin calls, such as through trading platform alerts, emails, or SMS notifications. Traders need to understand their broker’s specific margin call policies and procedures to effectively manage their trading accounts and avoid potential issues.

What Tools and Strategies Can Help Avoid Margin Calls in Forex?

Several tools and strategies can help traders avoid margin calls and manage risk effectively. One such tool is the use of margin calculators, which help determine the required margin for a trade based on leverage, trade size, and account balance. By using margin calculators, traders can better understand the impact of their trading decisions and ensure they maintain sufficient margin levels.

Implementing automated trading tools such as stop-loss and take-profit orders can also help manage risk and avoid margin calls. These tools automatically execute trades at predefined levels to limit losses or secure profits, reducing the likelihood of significant account drawdowns. Additionally, trading alerts and monitoring tools can provide real-time updates on market conditions and account status, enabling traders to take timely action to maintain their margin levels and avoid margin calls. Regularly reviewing and adjusting trading strategies based on market analysis and performance can further enhance risk management and reduce the risk of margin-calls.

What Are the Legal Implications of Margin Calls in Forex?

The legal implications of margin-calls in Forex trading primarily revolve around the contractual obligations between the trader and the broker. Margin calls are generally a standard part of the trading agreement, outlined in the broker’s terms and conditions. Traders are legally bound to maintain sufficient margin levels and respond to margin calls as specified in the agreement. Failure to meet margin-calls can lead to the automatic liquidation of positions, which is a contractual right of the broker to mitigate risk.

In some cases, ignoring a margin-call or not maintaining an adequate margin may lead to additional legal consequences, such as claims for damages or disputes over the broker’s actions. Traders may also face challenges if they believe that the margin call or liquidation process was handled improperly or unfairly. It is important for traders to be aware of their rights and responsibilities as outlined in their trading agreements and to seek legal advice if they encounter disputes related to margin calls or broker actions.

How Do Margin Calls Affect Forex Market Volatility?

Margin calls can significantly impact Forex market volatility, particularly during periods of high leverage and market stress. When a margin-call is triggered, brokers may liquidate positions to protect against further risk. These forced liquidations can result in a surge of sell orders in the market, contributing to increased volatility and sharp price movements. As traders scramble to adjust their positions or add funds to meet margin-calls, market liquidity can fluctuate, further amplifying volatility.

Additionally, the process of margin-calls can create a feedback loop in volatile markets. As prices move rapidly, more traders may face margin calls, leading to additional liquidations and further market instability. This can create a cascading effect, where the initial impact of margin-calls exacerbates market volatility. Understanding the potential effects of margin calls on market dynamics is crucial for traders, as it can influence trading strategies and risk management practices.

Margin-calls are a critical aspect of Forex trading, serving as a mechanism to protect both traders and brokers from excessive losses. Understanding how margin calls work, including their triggers, consequences, and the role of leverage, is essential for effective risk management. Brokers handle margin calls through various procedures, but all share the common goal of maintaining account security. Traders must be proactive in managing their margins to avoid the financial and operational impacts of margin calls, which can include forced liquidations and potential legal issues.

Risk management strategies such as using lower leverage, setting stop-loss orders, and maintaining adequate account balances are vital for preventing margin calls. Additionally, traders should familiarize themselves with their broker’s margin call policies and be aware of the legal implications tied to margin calls. The impact of margin calls on market volatility can be significant, influencing overall market dynamics and creating potential opportunities or risks. By employing effective tools and strategies, traders can better navigate the complexities of margin calls and maintain a more stable trading experience.