In the world of forex trading, understanding currency pairs is fundamental. A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. This mechanism is central to the forex market, where traders buy and sell currencies in pairs, making it one of the most liquid markets globally. The major currency pairs, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF, are highly traded and provide numerous opportunities for investors. In this article, we will explore the intricacies of currency pairs, their importance in forex trading, and the key factors that influence their values.

Currency pairs are essential in forex trading as they allow traders to speculate on the relative strength of one currency against another. Trading in the forex market always involves buying one currency and selling another simultaneously. The price of the currency pair reflects the market’s view on the economic health, interest rates, and political stability of the countries involved. This dynamic creates opportunities for traders to profit from the fluctuations in exchange rates between different currencies.

How Do Currency Pairs Work in the Forex Market?

Currency pairs function as the foundation of all forex trades. When trading forex, you are simultaneously buying one currency and selling another. The first currency listed in a currency pair is known as the base currency, and the second is the quote currency. The price of a currency pair represents how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD currency pair, if the quote is 1.2000, it means that 1 euro is equivalent to 1.2000 US dollars.

Forex trading involves the continuous fluctuation of exchange rates, driven by various economic factors such as interest rates, inflation, and political stability. Traders speculate on these fluctuations to make a profit. For instance, if a trader believes that the euro will strengthen against the US dollar, they will buy the EUR/USD pair, anticipating that the price will rise. Conversely, if they believe the euro will weaken, they will sell the pair.

The forex market operates 24 hours a day, five days a week, allowing for constant trading opportunities. This continuous operation is due to the global nature of forex trading, with different markets opening and closing throughout the day. The high liquidity in the forex market means that currency pairs can be bought and sold quickly, with minimal price movement between transactions, making it an attractive market for traders.

What are Major Currency Pairs and Why are They Important?

Major currency pairs are the most traded pairs in the forex market, and they include the currencies of the world’s largest and most stable economies. The four major pairs are EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs are known for their high liquidity, tight spreads, and significant trading volumes. The EUR/USD pair is the most traded, accounting for a substantial portion of the global forex market due to the economic size and influence of the Eurozone and the United States.

The importance of major currency pairs lies in their predictability and stability. Because they involve the most stable and liquid currencies, these pairs are less susceptible to extreme volatility compared to minor or exotic pairs. This stability attracts a large number of traders, from institutional investors to individual retail traders, contributing to the high trading volumes and liquidity.

Moreover, major currency pairs are crucial for global trade and finance. They are often used in international transactions, investments, and as benchmarks for other financial instruments. For example, central banks and multinational corporations frequently trade these pairs to hedge against currency risk and facilitate cross-border operations. Understanding the dynamics of major currency pairs is essential for anyone involved in the forex market, as they provide insights into global economic trends and financial stability.

Which Currencies are Most Commonly Traded in Forex?

The Forex market is highly liquid, with a few currencies dominating trading activity due to their economic significance and stability. The U.S. dollar (USD) is the most commonly traded currency, appearing in approximately 88% of all Forex transactions. Its dominance is largely due to its role as the world’s primary reserve currency and its widespread use in global trade and finance. Other major currencies include the Euro (EUR), the second most traded currency, which represents the Eurozone’s economic power and stability.

The Japanese yen (JPY) and the British pound (GBP) are also heavily traded, reflecting the significant economic influence of Japan and the United Kingdom, respectively. The Australian dollar (AUD) and Canadian dollar (CAD) are notable for their links to commodities, particularly precious metals and oil. These major currencies are highly liquid and often used in various currency pairs, which facilitates easier execution of trades and tighter bid-ask spreads.

How are Currency Pairs Quoted and What Do Bid and Ask Prices Mean?

Currency pairs in Forex are quoted in terms of one currency relative to another. The price of a currency pair represents how much of the quote currency is needed to buy one unit of the base currency. For example, in the EUR/USD pair, the price tells you how many U.S. dollars are required to purchase one euro. Currency pairs are quoted with two prices: the bid price and the ask price.

The bid price is the price at which a trader can sell the base currency, while the ask price (or offer price) is the price at which they can buy the base currency. The difference between these two prices is known as the spread, which represents the cost of trading and is influenced by market liquidity and volatility. For instance, if the EUR/USD pair is quoted with a bid of 1.1200 and an ask of 1.1220, the trader can sell euros for 1.1200 USD and buy euros for 1.1220 USD. Understanding these quotes helps traders make informed decisions on when to enter or exit trades.

What is the Difference Between Base Currency and Quote Currency?

In a currency pair, the base currency is the first currency listed and represents the amount of the second currency (the quote currency) required to purchase one unit of the base currency. For instance, in the GBP/USD currency pair, the British pound (GBP) is the base currency, and the U.S. dollar (USD) is the quote currency. The value of the pair indicates how many U.S. dollars are needed to buy one British pound.

Conversely, the quote currency is the second currency listed in the pair and is used to determine the value of the base currency. It essentially acts as a benchmark for the base currency’s value. When trading, the movements in the base currency’s price relative to the quote currency determine the trade’s profitability. For example, if the GBP/USD pair increases from 1.3000 to 1.3100, it means the value of the British pound has risen relative to the U.S. dollar. Understanding the roles of base and quote currencies is crucial for analyzing and executing Forex trades effectively.

How Do Economic Factors Influence Currency Pair Prices?

Economic factors significantly influence currency pair prices, as they reflect the overall health and performance of a country’s economy. Key economic indicators, such as GDP growth rates, unemployment levels, inflation rates, and interest rates, play a major role in determining currency values. For instance, strong economic growth and low unemployment typically lead to a stronger currency, as they signal a robust economy that attracts foreign investment. Conversely, high inflation or economic stagnation can weaken a currency due to decreased purchasing power and lower investor confidence.

Central bank policies and interest rates are crucial economic factors impacting currency prices. When a central bank raises interest rates, it often leads to an appreciation of the currency, as higher rates offer better returns on investments denominated in that currency. Conversely, a decrease in interest rates can lead to currency depreciation as it lowers the attractiveness of investments in that currency. Central bank statements and monetary policy decisions are closely watched by Forex traders for their potential impact on currency values.

Geopolitical events and trade relations also influence currency pair prices. Political instability, conflicts, or changes in trade policies can create uncertainty and volatility in the currency markets. For example, trade tensions between major economies can affect exchange rates by altering trade balances and investor sentiment. Traders must stay informed about global economic developments and geopolitical events to anticipate their potential effects on currency pairs and adjust their trading strategies accordingly.

What are Minor and Exotic Currency Pairs?

Minor currency pairs, also known as cross-currency pairs, involve currencies from major economies but exclude the U.S. dollar. Examples include the EUR/GBP, EUR/JPY, and GBP/JPY pairs. These pairs typically feature currencies from developed countries with stable economies, and they are less liquid than major pairs but more liquid than exotic pairs. Minor pairs offer traders opportunities to diversify their trading strategies beyond the most heavily traded major pairs while still benefiting from relatively stable market conditions.

Exotic currency pairs involve one major currency and one currency from a smaller or emerging economy. Examples include the USD/TRY (U.S. dollar/Turkish lira) and EUR/ZAR (euro/South African rand). Exotic pairs are characterized by higher volatility and wider spreads due to lower liquidity and less stable economic conditions in the emerging markets. Trading exotic pairs can offer high rewards, but they also come with increased risk and can be influenced by factors such as political instability, economic uncertainty, and fluctuating commodity prices.

Understanding the differences between minor and exotic currency pairs helps traders manage risk and tailor their strategies. While minor pairs provide opportunities for diversification and may offer more stable trading conditions, exotic pairs require careful consideration due to their volatility and broader spreads. Traders should assess their risk tolerance and market knowledge before engaging in trades involving exotic currencies.

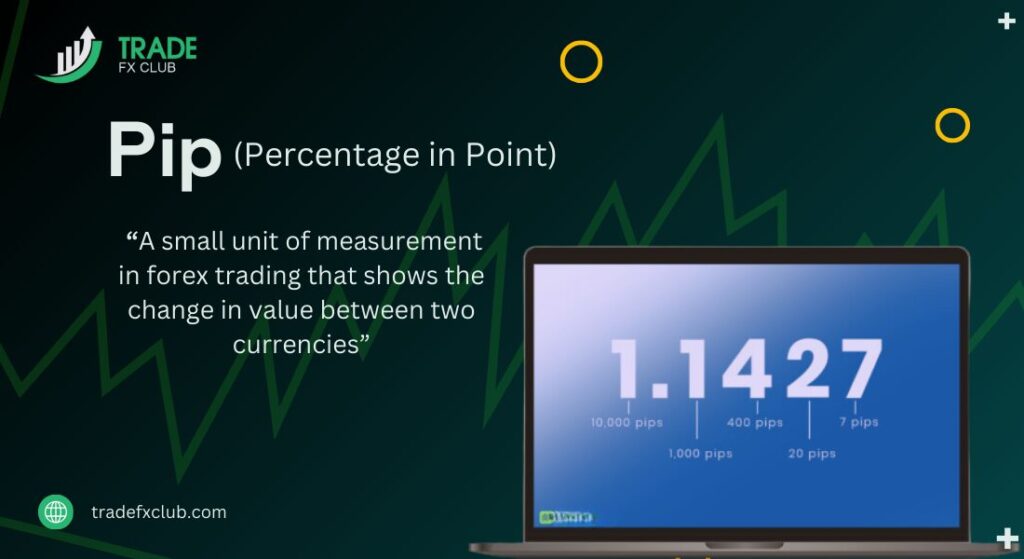

What are Pips and How Do They Work in Currency Pairs?

Pips (percentage in points) are the standard unit of measurement for the change in value between two currencies in a currency pair. In most currency pairs, a pip is the smallest price movement that can be observed, typically representing a change of 0.0001 in the exchange rate. For example, if the EUR/USD pair moves from 1.1200 to 1.1201, it has moved 1 pip. This measurement helps traders quantify price movements and assess potential profit or loss.

The concept of pips is crucial for understanding trade outcomes and calculating profit or loss. In Forex trading, the pip value can vary depending on the currency pair and the size of the trade. For most pairs quoted to four decimal places, one pip is equal to 1/100th of a percent or 0.0001. For pairs involving the Japanese yen (JPY), which are quoted to two decimal places, a pip represents a change of 0.01. Traders use pip calculators or trading platforms to determine the monetary value of a pip based on their position size and currency pair.

Pips are integral to managing trades and implementing risk management strategies. By tracking pip movements, traders can set stop-loss and take-profit levels to control risk and secure gains. Understanding pip values helps traders make informed decisions regarding trade size and potential returns, allowing them to plan their trading strategies more effectively.

How to Calculate the Value of a Pip in Different Currency Pairs?

Calculating the value of a pip in different currency pairs involves understanding how changes in the exchange rate affect the monetary value of a pip. For most currency pairs quoted to four decimal places, such as EUR/USD, a pip represents a change of 0.0001 in the exchange rate. To determine the pip value, you first need to consider the size of your trade, typically measured in lots. The standard lot size in Forex trading is 100,000 units of the base currency. By multiplying the pip movement by the trade size, you can estimate the pip’s monetary value.

For currency pairs that involve the Japanese yen, quoted to two decimal places, such as USD/JPY, the pip value calculation differs slightly. In these pairs, a pip represents a change of 0.01 in the exchange rate. When calculating the pip value for yen pairs, the process involves adjusting for this difference in decimal placement and considering the size of the trade. Typically, the pip value in yen pairs is calculated based on the lot size and current exchange rate, reflecting how much a one-pip movement impacts the trade’s monetary value.

Understanding the value of a pip is crucial for managing risk and assessing potential profits or losses. By knowing how much each pip movement translates into in terms of currency, traders can make more informed decisions about trade sizes and stop-loss levels. This knowledge helps in planning trades and managing exposure effectively, ensuring that traders can better control their risk and align their trading strategies with their financial goals.

What Role do Central Banks Play in Forex Markets?

Central banks play a pivotal role in the Forex markets by implementing monetary policies that influence currency values. Their primary tools include setting interest rates, conducting open market operations, and engaging in currency interventions. Changes in interest rates, for example, directly affect a currency’s value by altering the returns on investments denominated in that currency. Higher interest rates tend to attract foreign capital, leading to currency appreciation, while lower rates can have the opposite effect.

Central banks also intervene directly in the Forex markets to stabilize or influence their currency’s value. This intervention can be through buying or selling their own currency in the foreign exchange market to affect supply and demand dynamics. For instance, if a currency is appreciating too rapidly, a central bank might sell its currency to bring its value down. Additionally, central bank statements and policies are closely watched by traders as they can signal future monetary policy changes, impacting currency markets significantly.

How to Trade Currency Pairs: Strategies and Tips for Beginners?

For beginners in Forex trading, starting with a clear and straightforward strategy is essential. One fundamental strategy is trend following, which involves identifying and trading in the direction of the prevailing market trend. Beginners can use technical indicators such as moving averages or trendlines to confirm trends and decide when to enter or exit trades. This approach simplifies decision-making by focusing on the direction of the market rather than attempting to predict reversals.

Another important tip is to practice sound risk management. This involves setting stop-loss orders to limit potential losses and determining appropriate trade sizes to avoid overexposure. Beginners should start with a demo account to gain experience without risking real money. Additionally, maintaining a trading journal to record trades, strategies, and outcomes helps in analyzing performance and learning from mistakes. By focusing on these basic strategies and tips, beginners can build a solid foundation for their Forex trading journey and increase their chances of long-term success.

What are the Risks Involved in Trading Currency Pairs?

Trading currency pairs involves several risks that traders must manage to protect their capital and achieve consistent results. Market risk is a significant factor, as currency prices can be highly volatile and subject to sudden changes due to economic data releases, geopolitical events, or changes in market sentiment. This volatility can lead to substantial losses if the market moves against a trader’s position. Effective risk management strategies, such as using stop-loss orders and setting appropriate trade sizes, are essential to mitigate this risk.

Leverage risk is another crucial consideration in Forex trading. Leverage allows traders to control large positions with a relatively small amount of capital, amplifying both potential profits and losses. While leverage can enhance gains, it also increases the risk of significant losses if the market moves unfavorably. Traders should use leverage cautiously and ensure they fully understand its impact on their trading account. Additionally, liquidity risk can arise, especially in less traded currency pairs, where low trading volumes might lead to difficulty in executing trades at desired prices.

How to Use Technical Analysis for Currency Pair Trading?

Technical analysis involves using historical price data and chart patterns to forecast future price movements in currency pairs. Traders employ various technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to identify trends, potential reversal points, and market momentum. By analyzing historical price charts, traders can spot patterns like head and shoulders or double tops/bottoms that may signal future price movements. These tools help traders make informed decisions about when to enter or exit trades based on observed market behavior.

Chart patterns and trendlines are also fundamental components of technical analysis. Traders draw trendlines to identify the direction of the market and support or resistance levels where price changes might occur. Recognizing chart patterns such as triangles, flags, or wedges can provide insights into potential breakout or breakdown scenarios. Combining these patterns with technical indicators enhances the accuracy of trading signals and helps traders develop a comprehensive strategy for currency pair trading.

What are the Benefits of Trading Major Currency Pairs?

Trading major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, offers several advantages due to their high liquidity and tight spreads. Liquidity ensures that large trades can be executed quickly without significantly affecting the market price, which is beneficial for both short-term and long-term traders. The tight spreads associated with major pairs reduce trading costs, making it more cost-effective to enter and exit trades. Lower transaction costs can improve overall profitability and efficiency.

Another benefit of trading major currency pairs is their relatively lower volatility compared to exotic or minor pairs. Major currencies are influenced by more stable economic factors and tend to have less drastic price swings. This stability provides a more predictable trading environment, which can be advantageous for traders seeking to minimize risk and make informed decisions. Additionally, major currency pairs are well-covered by financial news and analysis, providing traders with ample resources to stay updated on market developments and make informed trading decisions.

How Do Currency Correlations Impact Forex Trading?

Currency correlations refer to the relationship between the movements of different currency pairs, where a positive correlation means that two pairs tend to move in the same direction, and a negative correlation means they move in opposite directions. Understanding these correlations can help traders manage risk and make more informed trading decisions. For example, if two currency pairs are positively correlated, a trader holding a position in one pair might be exposed to similar risks in the other. By recognizing these correlations, traders can avoid overexposing their portfolios to the same market movements.

Currency correlations also help in diversifying trading strategies. Traders can use negative correlations to balance their portfolios by taking positions in pairs that move in opposite directions. For instance, if a trader is long on EUR/USD and anticipates a potential drop, they might consider a short position in USD/JPY, which may move in the opposite direction. This strategy can reduce overall risk and stabilize returns by offsetting potential losses from one position with gains from another.

Moreover, understanding currency correlations can aid in identifying trading opportunities. For instance, if a trader notices a strong correlation between GBP/USD and EUR/USD, they might use this information to predict price movements and align their trades accordingly. Analyzing correlations helps traders anticipate how changes in one currency pair might affect others, allowing for more strategic and informed trading decisions.

What Tools and Platforms are Best for Trading Currency Pairs?

When trading currency pairs, trading platforms are essential tools that provide the necessary features and functionality for executing trades efficiently. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer advanced charting tools, technical indicators, and automated trading capabilities. These platforms are known for their user-friendly interfaces and extensive customization options, allowing traders to tailor their trading environment to their needs. The integration of tools like Expert Advisors (EAs) for automated trading also enhances trading efficiency.

Analytical tools are equally important in Forex trading. Traders benefit from access to real-time news feeds, economic calendars, and market analysis tools. News feeds provide up-to-date information on economic events and geopolitical developments that can impact currency markets. Economic calendars track important data releases and central bank announcements, while market analysis tools help in interpreting trends and price patterns. Using these tools helps traders stay informed and make data-driven decisions.

Risk management tools are critical for protecting trading capital. Position size calculators and risk management calculators help traders determine appropriate trade sizes and set stop-loss and take-profit levels based on their risk tolerance. Many trading platforms offer built-in risk management features, but external tools and apps can provide additional functionality and customization. Utilizing these tools helps traders manage risk effectively and maintain control over their trading strategies.

What are the Historical Trends in Major Currency Pairs?

Historical trends in major currency pairs reflect the long-term behavior and patterns observed in the Forex market. For instance, the EUR/USD pair, being the most traded currency pair, has shown periods of significant volatility influenced by European economic conditions, U.S. monetary policy, and global economic events. Historically, the EUR/USD has experienced trends driven by shifts in interest rates, economic data releases, and geopolitical developments, providing traders with insights into its potential future movements.

The GBP/USD pair, often referred to as “Cable,” has experienced notable historical trends influenced by factors such as Brexit negotiations, changes in the Bank of England’s monetary policy, and economic performance in the UK. These events have led to periods of both strong volatility and relative stability. Historical analysis of GBP/USD trends helps traders understand how political and economic developments impact the pair and anticipate similar impacts in the future.

The USD/JPY pair is influenced by factors such as U.S. interest rate policies, Japanese economic data, and global risk sentiment. Historically, the USD/JPY has been characterized by periods of relative stability with occasional spikes in volatility during major economic or political events. Analyzing historical trends in USD/JPY helps traders understand its typical behavior and prepare for potential shifts driven by changes in economic conditions or market sentiment.

How Does Leveraged Trading Affect Currency Pairs?

Leveraged trading significantly amplifies both potential profits and potential losses in the Forex market. By using leverage, traders can control a larger position in a currency pair with a relatively small amount of capital. For instance, with a leverage ratio of 100:1, a trader can control a position size of $100,000 with just $1,000 in their trading account. This ability to trade larger positions with a smaller initial investment can lead to higher returns if the market moves in the trader’s favor, making leverage a powerful tool for enhancing trading gains.

However, the increased potential for profit comes with an equally increased risk of substantial losses. If the market moves against a leveraged position, the losses can exceed the initial investment, leading to a margin call or even the liquidation of the trading account. For example, in the same scenario where a trader uses 100:1 leverage, a 1% adverse move in the market could result in a 100% loss of the trader’s capital. This magnification of risk requires traders to be cautious and manage their positions carefully to avoid significant financial damage.

To effectively manage the risks associated with leveraged trading, traders should implement robust risk management strategies. This includes setting stop-loss orders to limit potential losses, using appropriate position sizes relative to their account balance, and closely monitoring market conditions. Proper leverage management helps ensure that traders can take advantage of the benefits of leverage while mitigating the risks, allowing for more controlled and strategic trading in the Forex market.

In summary, understanding the complexities of currency pairs is fundamental to successful Forex trading. From recognizing the impact of economic factors and central banks to grasping the significance of currency correlations and technical analysis, each aspect plays a crucial role in shaping trading strategies and outcomes. Knowledge of how to calculate pip values, manage leverage, and interpret historical trends provides traders with the tools needed to navigate the dynamic Forex market effectively.

Moreover, selecting the right trading platforms, utilizing appropriate analytical tools, and applying sound risk management practices are essential for optimizing trading performance. Whether trading major, minor, or exotic currency pairs, traders must stay informed and adapt to evolving market conditions. By integrating these insights and strategies, traders can enhance their decision-making processes, mitigate risks, and capitalize on opportunities for more consistent and successful trading outcomes.