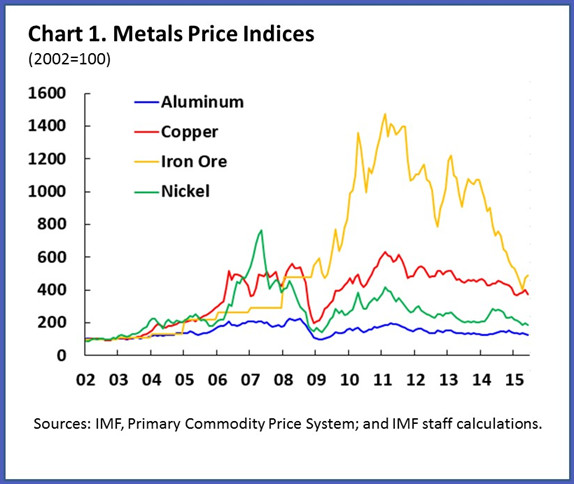

Key Factors Influencing Metals Prices: A Comprehensive Analysis

Metals prices are influenced by a complex array of factors, including supply and demand dynamics, economic indicators, geopolitical events, and market sentiment. Understanding these factors is crucial for traders, investors, and industry professionals to make informed decisions in the metals market.

Supply and Demand Dynamics

- Production levels: Changes in global production levels, including mine closures, new projects, and production ramp-ups, impact metal supply.

- Recycling and scrap metal: Recycling and scrap metal availability influence supply and demand balances.

- Inventory levels: Changes in inventory levels, including warehouse stocks and exchange-traded funds (ETFs), impact market sentiment and prices.

Economic Indicators

- GDP growth: Global economic growth drives demand for metals, particularly in construction, manufacturing, and infrastructure development.

- Inflation rates: Rising inflation can lead to increased demand for precious metals as a hedge against inflation.

- Interest rates: Changes in interest rates impact borrowing costs, influencing demand for metals.

Geopolitical Events

- Trade policies and tariffs: Trade tensions, tariffs, and quotas impact global supply chains and demand.

- Conflict and instability: Geopolitical conflicts, particularly in major producing countries, can disrupt supply and impact prices.

- Regulatory changes: Changes in environmental, labor, or trade regulations can impact production costs and supply.

Market Sentiment

- Investor sentiment: Market sentiment, including speculation and positioning, influences prices.

- Currency fluctuations: Changes in currency values, particularly the US dollar, impact metal prices.

- Central bank policies: Central bank actions, including quantitative easing and forward guidance, influence market sentiment.

Other Factors

- Technological advancements: Innovations in extraction, processing, and recycling impact supply and demand.

- Environmental concerns: Growing environmental awareness and regulations influence demand for certain metals.

- Substitution and alternatives: Substitution with alternative materials or recycling can impact demand.

Conclusion

Metals prices are influenced by a complex array of factors, including supply and demand dynamics, economic indicators, geopolitical events, and market sentiment. Understanding these factors is crucial for making informed decisions in the metals market. By analyzing these factors, traders, investors, and industry professionals can navigate market volatility and capitalize on opportunities.