A Stop-Loss Order is a fundamental risk management tool used by traders to limit potential losses in financial markets. By setting a predefined price level at which an open position will automatically close, traders can protect their investments from significant downturns. This order type is particularly popular among investors looking to safeguard their capital in volatile market conditions. Understanding how stop-loss orders work and how to implement them effectively is crucial for anyone involved in trading, whether in stocks, forex, or cryptocurrencies.

Stop-loss orders are particularly valuable in fast-moving markets where prices can change rapidly. They allow traders to step away from the market, knowing that their positions are safeguarded against significant losses. Without a Stop-Loss Order, traders would need to monitor their positions constantly, which can be stressful and impractical, especially in highly volatile environments.

How Does a Stop-Loss Order Work?

A Stop-Loss Order works by automatically triggering the sale of a security when its price falls to the predetermined stop price. Once the stop price is reached, the Stop-Loss Order becomes a market order, meaning the security will be sold at the best available price. This mechanism ensures that the trader’s losses are limited, even if the market continues to decline.

For example, if a trader buys a stock at $100 and sets a Stop-Loss Order at $90, the order will be executed if the stock’s price falls to $90 or lower. This automatic execution helps protect the trader’s capital by ensuring that they exit the trade before the losses become too substantial. However, it’s important to note that in highly volatile markets, the final sale price could be lower than the stop price, depending on market conditions at the time of the order execution.

Why Do Traders Use Stop-Loss Orders?

Traders use Stop-Loss Orders as a crucial part of their risk management strategy. The main reason for using a Stop-Loss Order is to limit potential losses on trade, ensuring that a position does not result in a catastrophic financial setback. By setting a clear exit point, traders can control their risk exposure and make more informed decisions, rather than reacting emotionally to market fluctuations.

Stop-loss orders also help traders maintain discipline. In the heat of trading, emotions like fear and greed can lead to poor decision-making, such as holding onto a losing position in the hope that it will recover. With a Stop-Loss Order in place, the decision to exit the trade is made in advance, based on logic rather than emotion. This discipline can be especially beneficial in volatile markets, where rapid price movements can quickly turn a profitable trade into a loss.

Additionally, Stop-Loss Orders allow traders to manage multiple positions more effectively. By automating the exit strategy, traders can focus on analyzing new opportunities rather than constantly monitoring existing positions. This automation is particularly useful for active traders who need to juggle several trades simultaneously without losing track of their risk management strategies.

What are the Different Types of Stop-Loss Orders?

Stop-loss orders come in several variations, each designed to suit different trading strategies and risk tolerance levels. The most common type is the standard stop-loss order, which triggers a market order when the asset reaches the stop price. This type of order ensures that the asset is sold as soon as the stop price is hit, but the final sale price may vary depending on market conditions at the time of execution.

Another popular variant is the trailing stop-loss order, which automatically adjusts the stop price as the market price moves in the trader’s favor. For example, if a trader sets a trailing stop-loss at 5% below the current market price, the stop price will move up as the market price increases. This allows traders to lock in profits while still protecting against downside risk. However, if the market price decreases, the stop price remains fixed, ensuring that the trader exits the position before losses become too large.

A third type is the stop-limit order, which combines features of both stop-loss and limit orders. In this case, the order triggers a limit order instead of a market order once the stop price is reached. While this provides more control over the execution price, it also carries the risk that the order may not be executed if the limit price is not met. This type of order is useful for traders who are concerned about slippage but still want to protect their positions from significant losses.

How to Set a Stop-Loss Order Effectively?

Setting a Stop-Loss Order effectively requires a balance between risk management and market conditions. The first step is to determine your risk tolerance—how much of a loss you are willing to accept on a particular trade. This will help you decide where to place your stop price. A common strategy is to set the stop-loss level based on a percentage of the asset’s current price, such as 2% or 5%, depending on your risk appetite.

It’s also important to consider market volatility when setting a Stop-Loss Order. In highly volatile markets, prices can fluctuate widely within short periods. Setting your stop price too close to the current market price might result in the order being triggered prematurely due to normal market noise. To avoid this, traders often use the Average True Range (ATR) indicator, which measures market volatility, to help determine an optimal stop-loss level that accounts for these fluctuations.

Finally, continuously monitor and adjust your stop-loss orders as market conditions change. If the asset’s price moves favorably, consider moving your stop price up to lock in profits, a strategy known as a trailing stop. However, avoid frequently changing your stop-loss levels based on short-term market movements, as this could lead to overtrading and reduce the effectiveness of your risk management strategy.

What are the Advantages of Using Stop-Loss Orders?

One of the primary advantages of using Stop-Loss Orders is risk management. By setting a predefined exit point, traders can protect themselves from significant losses, ensuring that they do not lose more than they can afford on any single trade. This is particularly important in volatile markets, where prices can swing rapidly, potentially leading to large, unexpected losses.

Another key advantage is the ability to remove emotion from trading decisions. Emotional decision-making, driven by fear or greed, can lead to holding onto losing positions for too long or selling winning positions too early. With a Stop-Loss Order, the exit strategy is determined in advance, based on logical criteria rather than emotional reactions. This helps traders stick to their trading plan and maintain discipline, which is crucial for long-term success.

Stop-loss orders also offer convenience and efficiency. They allow traders to step away from the market without constantly monitoring their positions, knowing that their trades will be closed automatically if the stop price is reached. This is particularly useful for traders who manage multiple positions or who cannot be in front of their trading screens at all times. By automating the exit process, Stop-Loss Orders enable traders to manage their time more effectively and focus on identifying new trading opportunities.

What are the Disadvantages of Using Stop-Loss Orders?

While Stop-Loss Orders are valuable tools for risk management, they also have some drawbacks. One of the primary disadvantages is market volatility. In highly volatile markets, prices can fluctuate dramatically within short periods, leading to the premature triggering of Stop-Loss Orders. This phenomenon, often referred to as “stop-hunting,” occurs when a price briefly dips to the stop level before rebounding, causing the trader to exit the position unnecessarily and potentially miss out on future gains.

Another disadvantage is the lack of control over the execution price. When a Stop-Loss Order is triggered, it becomes a market order, meaning the asset is sold at the best available price. In fast-moving markets, the actual execution price may differ significantly from the stop price, leading to a larger loss than anticipated. This slippage can be particularly problematic during periods of low liquidity or when the market is moving quickly against the trader’s position.

Lastly, Stop-Loss Orders can sometimes lead to overtrading. Traders may become overly reliant on stop-losses, setting them too close to the current market price out of fear of losses. This can result in frequent exits from trades, leading to higher transaction costs and reduced overall profitability. Traders need to strike a balance between using Stop-Loss Orders for protection and allowing their trades enough room to breathe in normal market conditions.

How Do Stop-Loss Orders Impact Trading Strategy?

Stop-loss orders play a crucial role in shaping a trader’s overall strategy by enforcing a disciplined approach to risk management. By setting clear exit points, traders can control their risk exposure on each trade, which is a fundamental aspect of successful trading. This helps in preventing significant losses that could otherwise erode trading capital, allowing traders to stay in the game longer and improve their chances of profitability over time.

The use of Stop-Loss Orders also impacts the psychology of trading. With predefined exit points, traders are less likely to make impulsive decisions driven by emotions such as fear or greed. This can lead to more consistent trading behavior and better adherence to the trader’s overall plan. Moreover, knowing that there is a safety net in place allows traders to take on positions with greater confidence, as they have already determined how much they are willing to risk.

However, the impact of Stop-Loss Orders on trading strategy is not always positive. If not used correctly, they can lead to missed opportunities. For example, setting a stop-loss too close to the entry price might result in the order being triggered by normal market fluctuations, causing the trader to exit a trade prematurely before the market moves in the anticipated direction. Therefore, the key to incorporating Stop-Loss Orders effectively into a trading strategy lies in setting them at levels that protect against significant losses while still allowing for market noise.

What is the Difference Between Stop-Loss and Stop-Limit Orders?

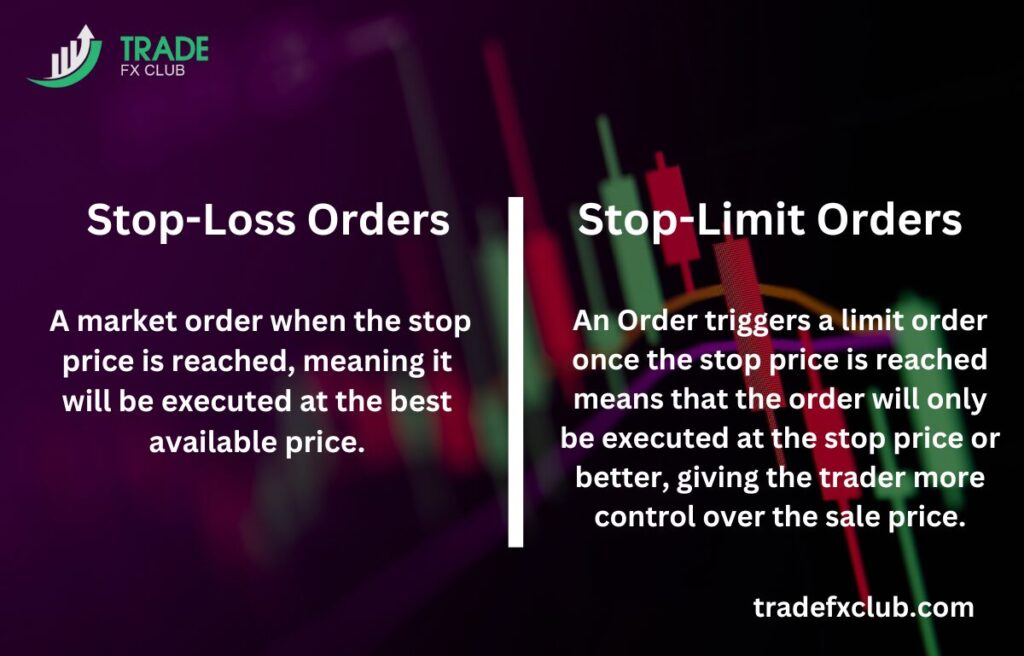

The primary difference between Stop-Loss and Stop-Limit Orders lies in how they execute once triggered. A Stop-Loss Order becomes a market order when the stop price is reached, meaning it will be executed at the best available price. This ensures that the position is closed, but the actual sale price may vary from the stop price, especially in fast-moving or volatile markets. The main advantage of this type of order is its simplicity and the assurance that the position will be closed to limit losses.

On the other hand, a Stop-Limit Order triggers a limit order once the stop price is reached. This means that the order will only be executed at the stop price or better, giving the trader more control over the sale price. However, there is a risk that the order may not be executed if the market moves too quickly and the limit price is not met. This can leave the trader holding a losing position, which could result in larger losses if the market continues to move against them.

In essence, while both orders are used to manage risk, they serve different purposes depending on the trader’s priorities. A Stop-Loss Order prioritizes ensuring the position is closed, regardless of the final sale price, making it suitable for traders who want to guarantee an exit. Conversely, a Stop-Limit Order provides more control over the execution price, making it ideal for traders who are more concerned about minimizing slippage but are willing to accept the risk that the order might not be filled.

When Should You Use a Trailing Stop-Loss Order?

A Trailing Stop-Loss Order is particularly useful in trending markets where the asset price is consistently moving in a favorable direction. This type of order allows traders to lock in profits as the price increases while still protecting against potential downturns. As the market price rises, the trailing stop automatically adjusts, maintaining a set distance below the market price. This means that if the market suddenly reverses, the order will trigger and protect the profits made up to that point. Trailing Stop-Loss Orders are ideal for traders who want to capitalize on strong trends without the need to constantly monitor their positions.

Another scenario where a Trailing Stop-Loss Order is beneficial is when a trader is unable to closely watch the market. Since the trailing stop adjusts automatically, it provides a dynamic risk management tool that can adapt to market conditions even in the trader’s absence. This is especially useful during periods of market volatility when prices can swing rapidly within a short time frame. By using a Trailing Stop-Loss, traders can ensure that their positions are managed effectively even if they are not actively monitoring the market.

However, it is important to use Trailing Stop-Loss Orders with caution in markets that are prone to sharp, unpredictable movements. In such cases, the trailing stop might be triggered prematurely by short-term volatility, causing the trader to exit a position before it has fully capitalized on the trend. To mitigate this, traders should consider setting a wider trailing stop distance in highly volatile markets to avoid being stopped out too soon.

How to Calculate the Optimal Stop-Loss Level?

Calculating the optimal Stop-Loss level is crucial for effective risk management and maximizing trading profitability. One common method is the percentage-based approach, where the stop-loss level is set as a fixed percentage of the entry price. For instance, a trader might decide to risk 2% of the trade’s value, meaning that the stop-loss is placed 2% below the entry price. This approach is simple and helps traders straightforwardly define their risk, but it may not account for market volatility or the specific characteristics of the asset being traded.

Another method involves using technical analysis tools, such as support and resistance levels, to determine the optimal stop-loss level. By placing the stop-loss just below a key support level or above a resistance level, traders can protect their positions against significant market moves while giving the trade enough room to fluctuate. This method is more tailored to the market context and can help avoid being stopped by normal market noise.

Additionally, traders can use the Average True Range (ATR) indicator to calculate the optimal stop-loss level. The ATR measures market volatility and helps traders set stop-loss levels that are in line with the asset’s typical price movements. By using a multiple of the ATR, such as 1.5 or 2 times the ATR, traders can place their stop-losses at a level that accommodates daily price fluctuations while still protecting against larger, unexpected moves. This method is particularly useful in volatile markets, where setting the stop-loss too close to the entry price could result in premature exits.

Can Stop-Loss Orders Protect Against Market Volatility?

Stop-loss orders can provide a degree of protection against market volatility, but they are not foolproof. In volatile markets, prices can swing rapidly, and a Stop-Loss Order can help traders limit losses by automatically closing a position when the market moves against them. This is particularly valuable during unexpected market events or news releases that cause sharp price movements. By having a Stop-Loss Order in place, traders can protect their capital from significant losses without needing to constantly monitor the market.

However, it’s important to understand that Stop-Loss Orders are not immune to the effects of market volatility. One of the main challenges is slippage, which occurs when the execution price of the Stop-Loss Order is different from the intended stop price. In highly volatile markets, prices can go down or up, leading to the order being filled at a less favorable price than anticipated. This can result in larger losses than expected, especially in markets with low liquidity or during periods of extreme volatility.

Additionally, Stop-Loss Orders can sometimes be triggered by short-term market noise. In highly volatile environments, the price of an asset might briefly dip to the stop-loss level before quickly rebounding. This can cause the trader to exit a position prematurely, missing out on potential gains as the market recovers. To mitigate this risk, traders may opt for a wider stop-loss or use indicators like the Average True Range (ATR) to set a stop level that better accommodates market volatility, ensuring that they are not stopped out by normal price fluctuations.

How Do Automated Trading Systems Utilize Stop-Loss Orders?

Automated trading systems, often referred to as algorithmic trading or “algos” extensively utilize Stop-Loss Orders as part of their risk management protocols. These systems are designed to execute trades based on pre-defined criteria, and Stop-Loss Orders are critical for ensuring that trades are closed out when the market moves against the position. By integrating Stop-Loss Orders into their algorithms, these systems can limit losses without requiring human intervention, allowing for more efficient and disciplined trading.

One of the key advantages of using automated systems with Stop-Loss Orders is their ability to execute trades with precision and speed. In volatile markets, where prices can change within milliseconds, the rapid execution of Stop-Loss Orders by an automated system can protect against significant losses that might occur if a trader were to react manually. Automated systems can also adjust Stop-Loss levels dynamically based on real-time data, ensuring that the risk management strategy adapts to changing market conditions.

Moreover, automated trading systems can implement advanced strategies such as trailing stop-loss orders, which adjust the stop level as the asset price moves in favor of the trade. This allows the system to lock in profits while still providing downside protection. For example, as the price of an asset rises, the trailing stop can move up accordingly, ensuring that profits are secured if the market reverses. This automated adjustment process is particularly beneficial in trending markets, where maximizing gains while minimizing losses is essential.

What are Common Mistakes When Setting Stop-Loss Orders?

One of the most common mistakes traders make when setting Stop-Loss Orders is placing them too close to the entry price. This can result in the order being triggered by normal market fluctuations or short-term volatility, causing the trader to exit a position prematurely. Setting the stop-loss too tight can lead to frequent small losses, which can add up over time and erode trading capital. It’s important to give the trade enough room to move, especially in volatile markets, to avoid being stopped by what is often referred to as “market noise.”

Another frequent mistake is failing to adjust stop-loss levels as market conditions change. Markets are dynamic, and what may have been an appropriate stop-loss level at the beginning of a trade may no longer be effective as the trade progresses. For instance, as the price moves in favor of the trade, traders should consider adjusting their stop-loss to lock in profits while still protecting against potential reversals. Ignoring the need to adjust stop-loss levels can result in missing out on gains or suffering larger losses than necessary.

Finally, some traders fall into the trap of ignoring their stop-loss orders altogether when emotions come into play. For example, if a trader is convinced that the market will turn around, they might cancel or move their stop-loss further away to avoid closing the position at a loss. This behavior can be dangerous, as it negates the purpose of the stop-loss, which is to limit potential losses. Traders must remain disciplined and adhere to their pre-determined risk management strategy, even when faced with the emotional pressures of trading.

How Can Stop-Loss Orders Influence Market Movements?

Stop-loss orders can have a significant impact on market movements, particularly in markets with lower liquidity or during periods of high volatility. When many traders set stop-losses around similar price levels, these orders can create a cascade effect. For example, if the price of an asset drops and hits a level where numerous stop-loss orders are clustered, the resulting automatic sales can drive the price down further, triggering even more stop-loss orders in a downward spiral. This can exacerbate price declines, leading to a sharp and sudden drop known as a “stop-run.”

Additionally, the presence of Stop-Loss Orders at certain price levels can be exploited by larger market participants, such as institutional traders. These entities may engage in a strategy known as **stop-hunting**, where they intentionally push the price to levels where they know stop-losses are likely to be triggered. Once these stop-loss orders are executed and the price falls sharply, these larger traders can then buy the asset at a lower price, capitalizing on the temporary market dislocation they’ve caused.

Moreover, Stop-Loss Orders can contribute to market stability by providing a natural point of exit for traders, thereby reducing the likelihood of panic selling. In volatile markets, the automatic execution of Stop-Loss Orders can help absorb selling pressure by ensuring that trades are exited in a controlled manner, rather than through emotional decision-making. This can prevent more severe market disruptions by limiting the extent of price swings and promoting orderly market behavior. However, in some cases, the concentration of Stop-Loss Orders at key levels can also contribute to market volatility if they are triggered en masse.

What Tools Can Help in Setting Stop-Loss Orders?

Several tools and indicators can assist traders in setting Stop-Loss Orders more effectively. One of the most commonly used tools is the Average True Range (ATR) indicator, which measures market volatility. By providing an average range of price movement over a specified period, the ATR helps traders set their stop-losses at levels that account for market volatility. For example, a trader might set a stop-loss at a multiple of the ATR value (e.g., 1.5 times the ATR), ensuring the stop-loss is wide enough to avoid being triggered by normal price fluctuations.

Another valuable tool is technical analysis software, which can help traders identify key support and resistance levels. Support levels are price points where an asset tends to find buying interest, preventing it from falling further, while resistance levels are where selling pressure tends to prevent the price from rising. By placing stop-losses just below support levels or above resistance levels, traders can protect their positions from significant downturns while allowing room for the price to fluctuate within its normal range.

Automated trading platforms and algorithmic trading systems also offer sophisticated tools for setting and adjusting stop-loss orders. These platforms can automatically set stop-losses based on pre-determined criteria, such as a percentage of the asset’s price or technical indicators like moving averages. Additionally, some platforms offer trailing stop-loss features, which automatically adjust the stop level as the asset’s price moves in the trader’s favor. These tools help traders manage risk more effectively, especially in fast-moving markets where manual adjustments might be too slow.

What are the Regulatory Implications of Stop-Loss Orders?

The use of Stop-Loss Orders is subject to various regulatory considerations, depending on the jurisdiction and the specific financial markets involved. In many regions, regulatory bodies oversee the trading practices of brokers and exchanges to ensure that Stop-Loss Orders are executed fairly and transparently. For example, in the United States, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) regulate how brokers handle Stop-Loss Orders to prevent market manipulation and ensure investor protection.

One key regulatory implication is the requirement for brokers to execute Stop-Loss Orders at the best available price once the stop price is reached. However, during periods of high volatility or low liquidity, there is a risk that Stop-Loss Orders may be executed at prices far from the stop level, known as slippage. Regulatory bodies often require brokers to disclose these risks to traders, ensuring that they are aware of the potential for slippage and its impact on their trades.

Another regulatory consideration involves market manipulation practices, such as stop-hunting, where larger traders or institutions intentionally move the market to trigger Stop-Loss Orders. Regulators monitor trading activities to detect and prevent such practices, which can unfairly disadvantage retail traders. Compliance with regulations helps maintain market integrity, ensuring that Stop-Loss Orders serve their intended purpose of protecting traders rather than being exploited for market manipulation.

How Have Stop-Loss Orders Evolved?

Stop-loss orders have evolved significantly over time, driven by advancements in technology and changes in market structures. In the early days of trading, stop-losses were often manually monitored and executed by traders or brokers, requiring constant vigilance and quick reactions to market movements. As electronic trading platforms emerged, the process became automated, allowing for faster and more precise execution of Stop-Loss Orders. This automation has made stop-losses more accessible and reliable, reducing the risk of human error and improving overall trading efficiency.

The development of algorithmic trading and sophisticated trading platforms has further enhanced the functionality of Stop-Loss Orders. Traders can now set complex stop-loss strategies, such as trailing stops and conditional orders, which automatically adjust based on market conditions. These innovations have made Stop-Loss Orders more dynamic and adaptable, enabling traders to manage risk more effectively in real time. The integration of technical indicators and advanced analytics into trading platforms has also allowed for more informed decision-making when setting stop levels.

In recent years, the rise of high-frequency trading (HFT) and increased market volatility have led to new challenges and considerations for Stop-Loss Orders. The speed and volume of trades executed by HFT firms can cause rapid price movements, triggering Stop-Loss Orders more frequently than in the past. In response, traders and platforms have developed more sophisticated algorithms and tools to manage these risks, such as using wider stop-loss levels or employing volatility-adjusted strategies. These developments reflect the ongoing evolution of Stop-Loss Orders as an essential component of modern trading strategies, continuously adapting to the changing landscape of financial markets.

Certainly! Here’s a detailed look at what to consider before using stop-loss orders in cryptocurrency trading and how different market conditions affect their use:

What Should You Consider Before Using Stop-Loss Orders in Cryptocurrency Trading?

1. Market Volatility:

Cryptocurrency markets are known for their high volatility, with prices often experiencing rapid and significant fluctuations. When setting stop-loss orders, it’s crucial to account for this volatility to avoid premature liquidation of your position. A stop-loss set too close to the current market price might trigger a sell-off during normal price swings, while one set too far away may not effectively limit potential losses. Analyzing recent price trends and volatility can help in determining an appropriate stop-loss level that balances risk and potential reward.

2. Trading Strategy and Risk Tolerance:

Your stop-loss placement should align with your overall trading strategy and risk tolerance. For instance, day traders might use tighter stop-loss orders to protect against short-term price movements, while long-term investors might opt for wider stop-loss levels to accommodate longer-term fluctuations. Assessing how much risk you are willing to take on each trade will help in setting a stop-loss level that protects your capital without overly constraining your trading opportunities.

3. Liquidity and Market Depth:

The liquidity of a cryptocurrency affects how easily you can buy or sell without impacting the market price. In markets with low liquidity, executing a stop-loss order might lead to slippage, where the actual execution price differs from the stop price. It’s important to consider the trading volume and order book depth of the cryptocurrency you are trading to ensure that your stop-loss orders can be executed at or near your desired price.

How Do Different Market Conditions Affect the Use of Stop-Loss Orders?

1. Trending Markets:

In a strong uptrend or downtrend, stop-loss orders can help protect gains or limit losses, but they require careful placement. In a strong uptrend, a trailing stop-loss can be used to lock in profits as the price rises while still allowing some room for the price to fluctuate. Conversely, in a downtrend, placing a stop-loss order might be more challenging as prices may continue to fall rapidly. Understanding the strength and duration of the trend can help in setting more effective stop-loss levels.

2. Sideways or Range-Bound Markets:

In a sideways or range-bound market, where prices move within a defined range, stop-loss orders might be triggered more frequently due to price fluctuations within the range. Setting stop-loss levels too close to the support or resistance boundaries can lead to frequent stop-outs. It’s beneficial to consider the range boundaries and adjust your stop-loss orders accordingly to avoid getting stopped out prematurely while still managing risk.

3. News and Events:

Market conditions can shift dramatically due to news or events such as regulatory announcements, technological developments, or macroeconomic factors. During significant news or events, volatility can spike, making stop orders more prone to slippage. Being aware of upcoming news and adjusting your stop order strategy in anticipation of increased volatility can help better manage risk during such periods.

In summary, stop orders are a crucial tool in cryptocurrency trading, offering a mechanism to manage risk and protect your investment from adverse market movements. By automatically selling an asset when it reaches a predefined price, stop orders can help traders avoid excessive losses and lock in profits. However, their effectiveness depends on careful consideration of market volatility, liquidity, and alignment with your overall trading strategy and risk tolerance.

Stop orders are invaluable for risk management, but they should be used thoughtfully. Traders must balance the need for protection with the potential for premature stop-outs, especially in volatile or trending markets. Regularly reviewing and adjusting your stop order levels in response to changing market conditions and your trading strategy can enhance their effectiveness and contribute to more successful trading outcomes.